Almost A Bank offers a very fast and easy way to get payday loans when you are short on cash. Just locate our branch nearest you, bring in the required information and you will have your cash in minutes. It is that simple!

Required Information

- Application - Click the Apply Now button below!

- Current Bank Statements (from checking or savings)

- Proof of Income

- Driver's License/Photo ID

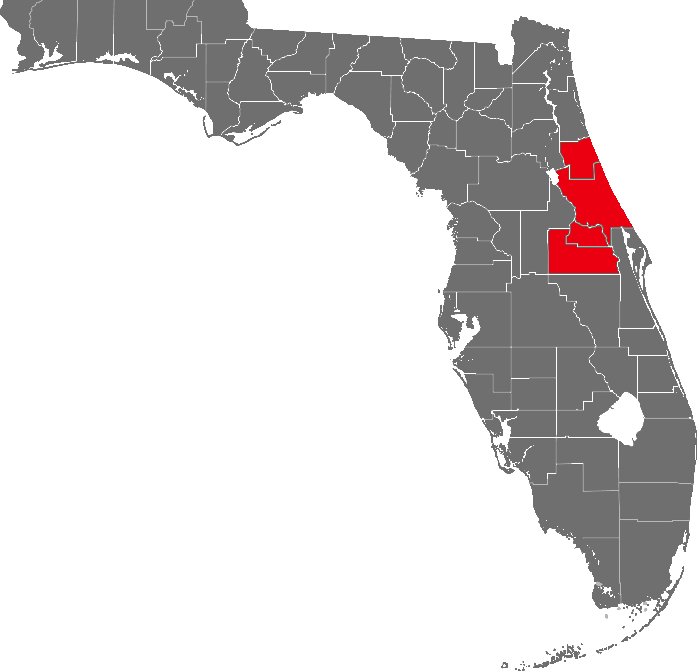

Almost A Bank is a licensed, bonded and insured lender serving Volusia, Flagler and Seminole Counties. Get Cash Today!

Complete our application below and you could get your money quicker and easier than ever before. Submit your application to the nearest Almost A Bank branch for processing to receive the cash you need until payday.

Get Cash Today

We know unpredictable events sometimes occur between paychecks, which is why we are here to help you make it to your next payday. When you need cash fast, or bank alternative solutions, Almost A Bank is your premiere resource.